AI is changing the world…

But machine learning models remain fragile, costing millions in testing and pre-deployment failures. The more advanced the model, the higher the risk. We offer deep validation via state of the art formal verification across industries, in ways that scale.

Speak to an expert

ML model developers and validation teams in financial trading, banking and computer vision industries – including aviation, robotics and drones – benefit from our product platform solutions.

Computer Vision – Aviation, Robotics & Edge

Computer vision powered by machine learning transformed the aviation, drone, and robotics industries. However, advanced validation – through deep verification and robustification – is critical for sustained model resilience and certification.

We work directly with aviation customers to validate high-stakes vision models for flight operations, runway and object detection, runway incursion, and prediction challenges on tabular data. We pioneered deep analysis verification that helps to meet emerging regulatory targets and robustifies models that fall short.

Our formal verification and large model analysis assess whole input space regions, not just test points. We also build libraries of environmental risks based on perturbations for continuous checking. These innovations reduce testing costs, improve result trustworthiness, and streamline workflow efficiency.

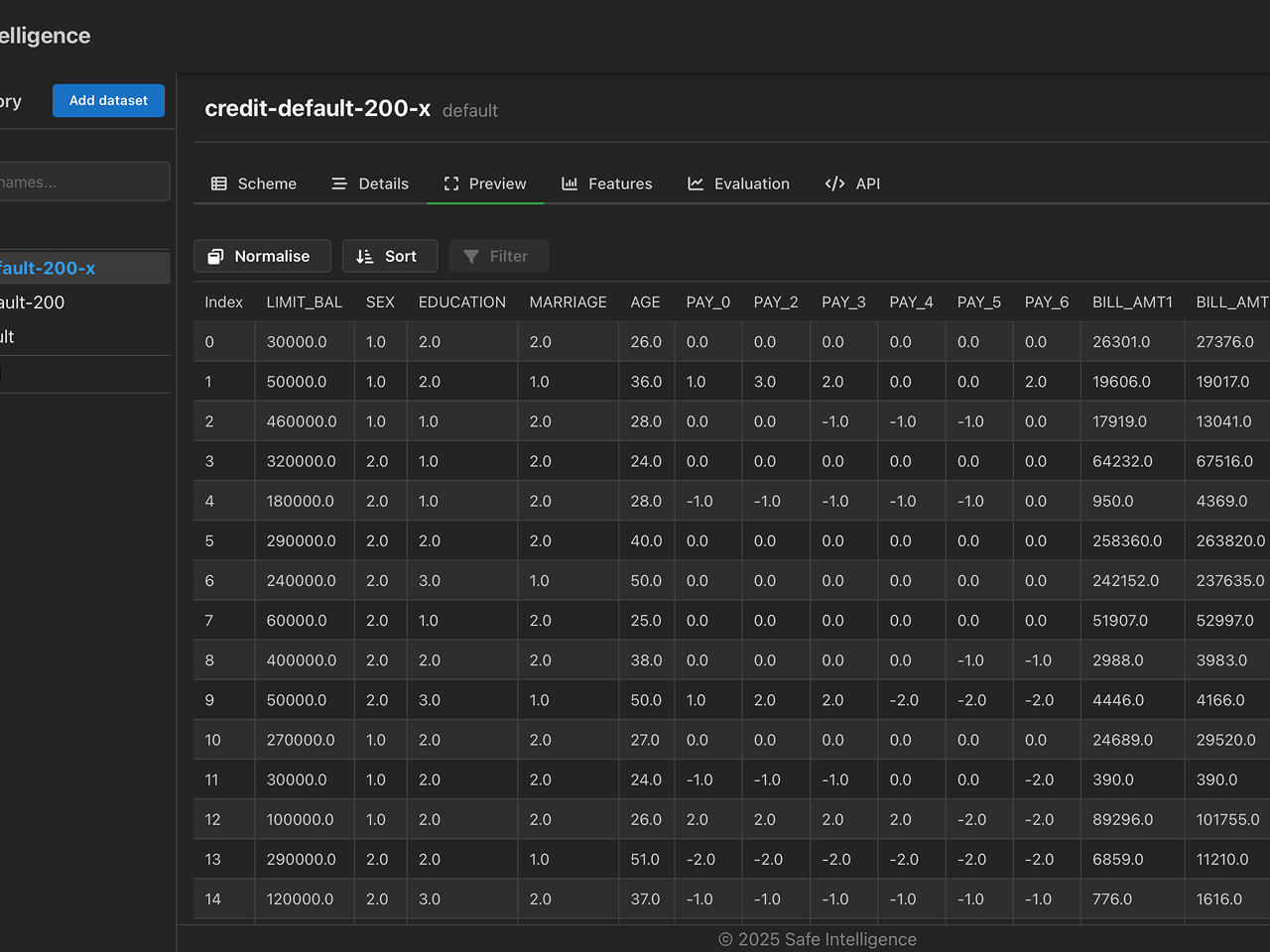

Banking/credit Risk

Machine learning is a cornerstone of modern credit risk management in banking. Predicting the probability of default is a critical metric, enabling more accurate, dynamic assessments of borrower reliability for customers ranging from individuals to SMBs and corporate loans.

Our banking customers seek enhanced accuracy, real-time adaptability, and granular segmentation. As a result, model validation in credit default typically emphasizes sensitivity and robustness. Safe Intelligence offers extremely thorough, deep verification sensitivity analysis, allowing multiple factors to be altered.

We also enable the building of superior regression models, which can translate to increased runtime profits and reduced risk. Our approach covers hidden factor identification, enhanced stability and broader bias analysis, process repeatability, and outcome documentation.

Trading & asset allocation

Machine learning models help guide financial trading by identifying useful market signals and automating investments. Accurately extracting winning strategies from historical data while minimizing risk is crucial. However, these models have high training costs and are susceptible to fragilities and drift.

Even models that perform well in backtesting may display poor trading results under nearly identical market conditions. And, as market situations shift, drift can degrade performance, raising both training and validation costs. This shortens model lifespans and leads to more retraining, higher costs, and increased downtime.

Safe Intelligence helps you develop more resilient models capable of trading longer without retraining. This includes decision models for asset allocation, feeder/signal models, neural networks, decision trees, random forests, and ensembles.

Get in touch

Tell us about your model, your goals and your particular use case challenges. We’re here to help

Speak to an expert